audit vs tax salary

Get your experience typically two years before getting your CPA license. The salary range for auditors based on 2434 respondents as of June 6 2011 was 34302 to 70761.

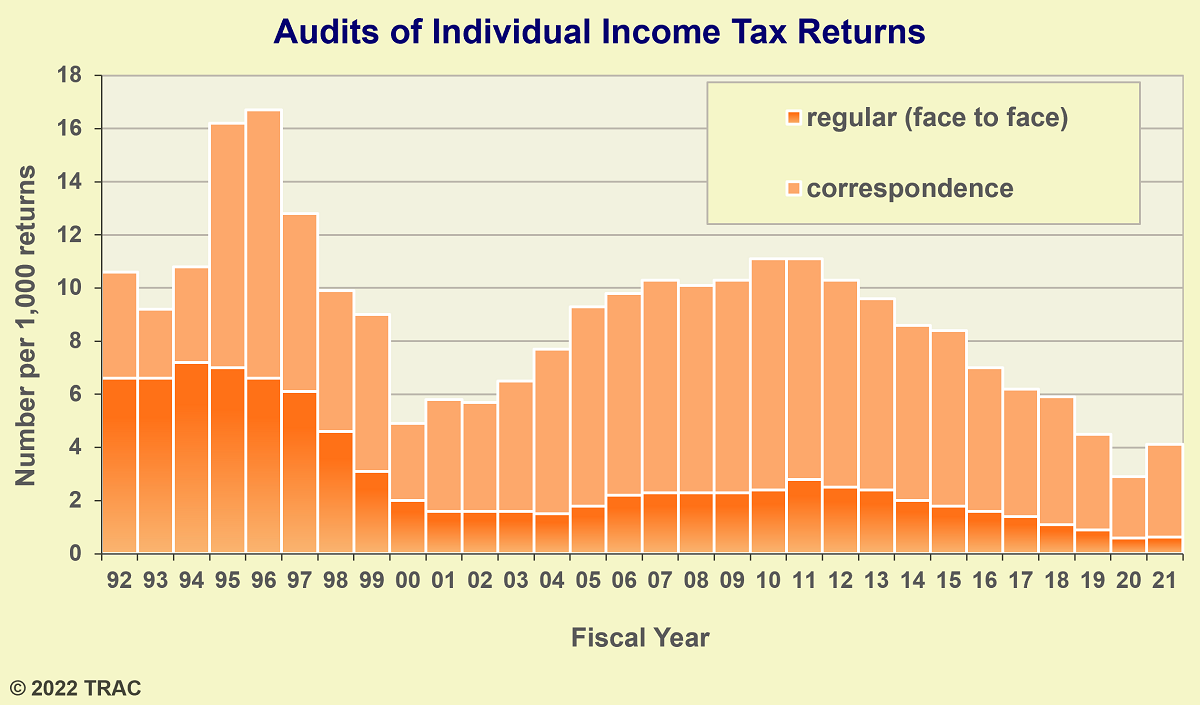

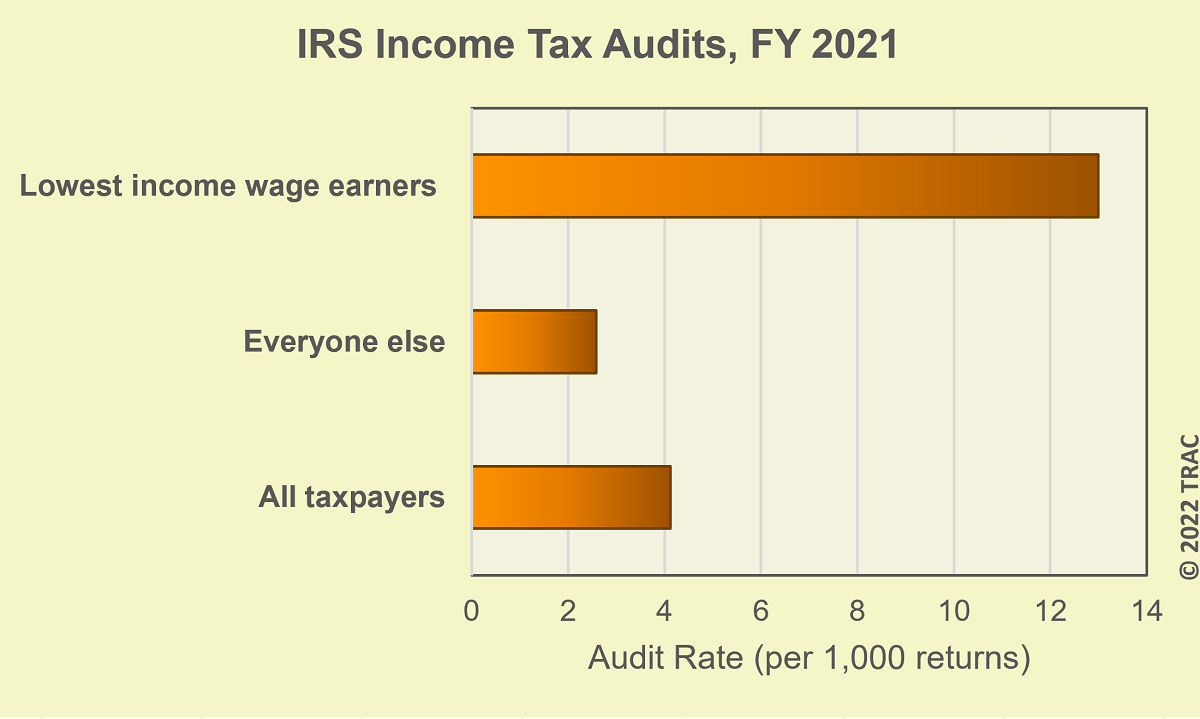

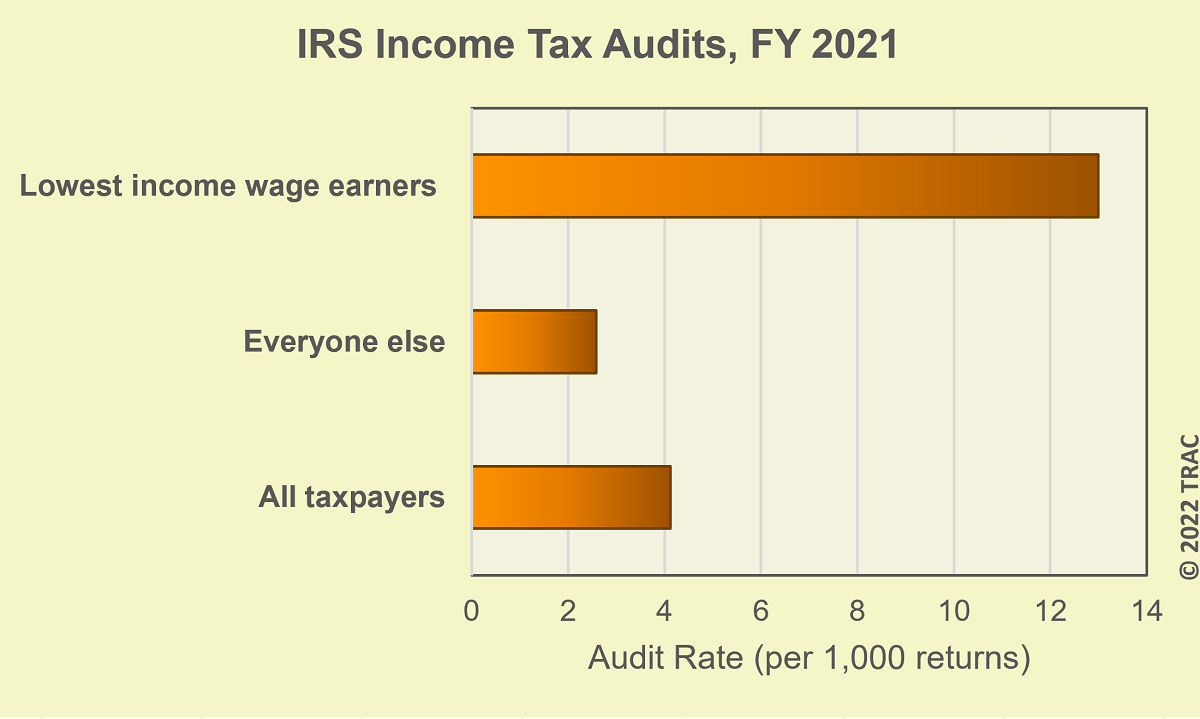

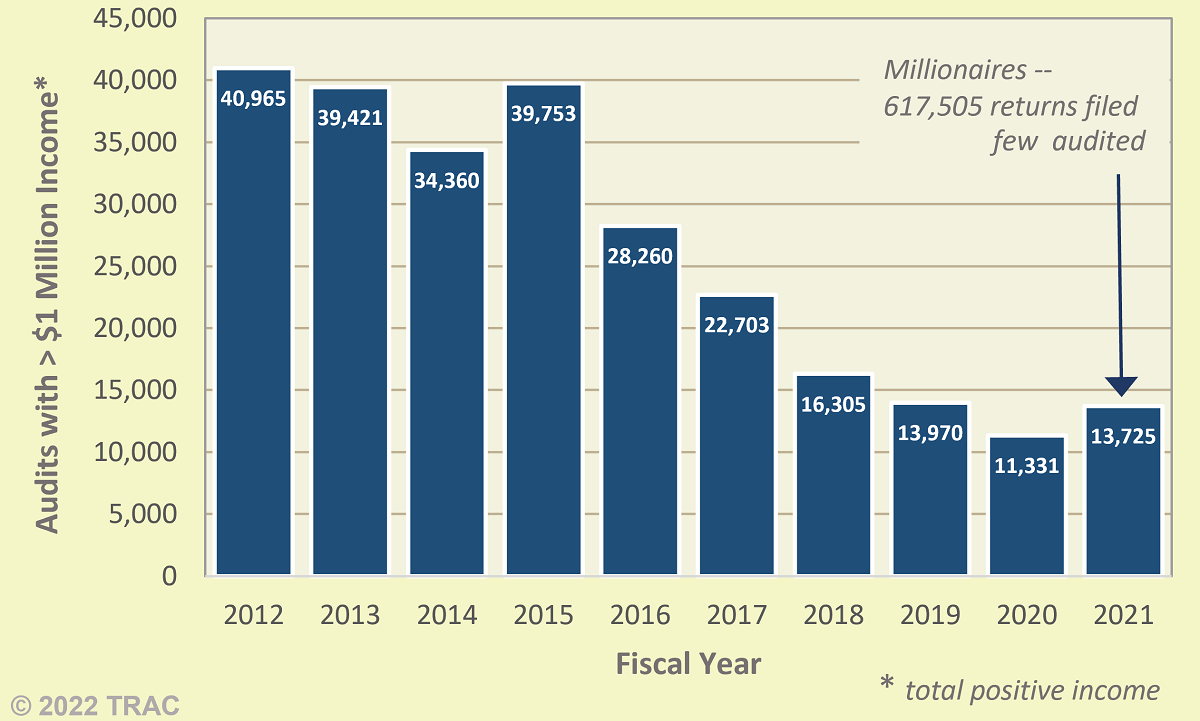

Irs Audits Poorest Families At Five Times The Rate For Everyone Else

Tax professionals must comply with rules set by the Internal Revenue Service and The US.

. Auditors must also follow generally accepted accounting principles GAAP generally accepted auditing standards GAAS additional SEC and PCAOB guidelines if required. If you want to move on audit for sure is the better choice. Especially to exact money from for the support of government.

But just isolating the work itself Id say tax is more interesting and you add more value to the client. Tax will pigeon hole you the more time you spend in tax the more you become the tax person no one will consider you for anything outside of tax the more time you spend in it. Its called a learning experience you learn from it and you move on to something better.

The key difference between tax accountants and auditors is that tax accountants specialize in helping businesses and individuals plan for minimize and file taxes while auditors ensure that accountants work is correct and following the law. You are willing to do literally the most boring work on the face of the planet for a reasonable salary and reasonable hours. The average salary for tax accountants based on a survey of 1641 respondents as of June 12 2011 was 34912 to 65595.

Salaries in the accounting field are attractive as well with the median annual wage for accountants and auditors at 67190. I work in Australia and here a lot of the tax grads have law degrees and as such in general the starting salary for tax is far higher. Audit vs tax accountant originally posted.

Could always start your own accounting firm as well. Tax is better but you need to leave after 2 years. The salary range for some of the largest employers include PricewaterhouseCoopers 40863-56951 Ernst and Young LLP 44644 to 72000 and Deloitte Tax LLP 48322 to 104296.

Tax accountants usually get paid more than auditors at least starting out. Aug 25 2012 - 349pm. Much better exit opportunities.

To impose a tax upon. Thats their main pipeline for entry lvl tas. Tax has a more specialized focus.

Where as auditors work in teams. Answer 1 of 3. The estimated total pay for a AuditTax is 98393 per year in the United States area with an average salary of 85555 per year.

The audit process will result in either an agreement or a disputed case. Tax Accountant vs Auditor. With the discovery internship program the qualified applicants are able to choose which services lines they wanted to pursue.

Here are some of the differences between both options. This year I believe it was something like 63-65000 full package for tax and 55000-58000 full package for audit. The estimated additional pay is 12838 per year.

Tax is all about pre-defined laws and the tax people tend to be more precise. Tax accountants influence business practices cash flow management and how businesses report their. Securities and Exchange Commission.

Tax actually has a higher salary though. Tax is relatively less flexible than audit. The big four firms set.

The average annual salary for an auditor is over 10 less than that of a Tax Accountant. Audit more client facing people respect it in most parts of business. To lay a burden upon.

To subject to the payment of a tax or taxes. There may be significantly fewer positions at some organizations. One caveat is that many firms will not hire undergrads directly into their tasfas groups.

The range for the firm Ernst and Young was 45344 to 68880. These numbers represent the median which is the midpoint of the ranges from our proprietary Total Pay Estimate model and based on salaries collected from our users. Audit is so much broader and lets you do more with your career.

Less competitive than auditing or consulting. Audit on the other hand is more flexible because it depends on multiple factors such as. Consultants earn a similar amount as tax grads as these people also tend to be either law grads or top grads from other degrees.

Audit vs Tax Originally Posted. I got more and more interested in tax related matters especially indirect and corporation tax with age and experience I. Both tax and audit are rules and research based.

Tax is a mandatory financial fee levied by the government on its citizens for public works and government spending. From what I understand itd probably be easier to establish one that. I know that can pay very well.

And tax is not everyones cup of tea. It depends on what interests you. The salary range for some of the largest employers include PricewaterhouseCoopers 40863-56951 Ernst and Young LLP 44644 to 72000 and Deloitte Tax LLP 48322 to 104296.

The average salary for tax accountants based on a survey of 1641 respondents as of june 12 2011 was 34912 to 65595. The starting salary at pwc is about 56000 for audit associates. Audit vs tax salary.

Auditors work with clients from day one where as tax staff might not see clients for the first one of two tax seasons. Tax may bring in more yield when it comes to profiting from practice. Exit opportunities are definitely better for audit.

To start your career audit offers a more broad perspective. Has a broader focus than tax. Tax accountants typically work individually.

As to audit the accounts of a treasure or of parties who have a suit depending in court. You are not tied down to only working in tax or only working in audit your entire career. Or their internships have given them.

In fact its rare now to work at one place or even one industry until retirement. To examine and adjust as an account or accounts. Big Four Accounting.

Difference Between Tax And Audit Difference Between

Checklist Of Documents For Filing Income Tax Return Tax Checklist Income Tax Income Tax Return

Last Date Of Income Tax Audit Report Filing Income Tax Last Date Tax

Accounting Swear Words Finance Office Humor Poster Zazzle Com Accounting Humor Word Poster Office Humor

Difference Between Audit And Tax Accounting The Big 4 Accounting Firms

Tax Fact 4 The Real Cost Of Audits Facts Tax Tax Season

What Is The Purpose Of Financial Accounting Management Guru Accounting Accounting Jobs Accounting Education

Irs Audits Poorest Families At Five Times The Rate For Everyone Else

What Are The Biggest Small Business Tax Mistakes Small Business Tax Business Tax Small Business Finance

Tax Vs Audit A Q A With Bs In Accounting Program Director John Barden Jindal Home

Govt Plans To Launch Gst E Invoices To Curb Tax Evasion Income Tax Return Audit Services Corporate Accounting

Tax Audit Definition Example Explanation And Types Wikiaccounting

Pin By Truejobs India On Truejobs India Account Executive Income Tax Candidate

1 Audit Services In Dubai Auditing Services Audit Firms In Dubai Uae Audit Services Business Valuation Accounting Services

Irs Audits Poorest Families At Five Times The Rate For Everyone Else

Audit Tax Business Partner Required In Dubai Work Experience Business Partner Accounting Services

Irs Audits Poorest Families At Five Times The Rate For Everyone Else

Auditing Tax Accounting Concepts Concept Accounting Accounting Logo